Training Course on Strategic Resource Allocation and Capital Deployment

Training Course on Strategic Resource Allocation and Capital Deployment empowers executives, managers, and financial professionals with the cutting-edge frameworks, tools, and methodologies required to make informed, data-driven decisions that drive profitability, foster innovation, and ensure long-term growth.

Skills Covered

Course Overview

Training Course on Strategic Resource Allocation & Capital Deployment

Introduction

In today's dynamic global marketplace, optimal resource allocation and strategic capital deployment are paramount for sustained organizational success and competitive advantage. Training Course on Strategic Resource Allocation and Capital Deployment empowers executives, managers, and financial professionals with the cutting-edge frameworks, tools, and methodologies required to make informed, data-driven decisions that drive profitability, foster innovation, and ensure long-term growth. We delve into both theoretical foundations and practical applications, leveraging real-world case studies to illustrate best practices in financial stewardship and investment strategy.

Organizations face continuous pressure to maximize returns on their limited resources. This course provides a comprehensive roadmap for navigating complex investment landscapes, identifying high-potential projects, and allocating capital to initiatives that directly align with strategic objectives. Participants will gain proficiency in portfolio optimization, risk management, and performance measurement, transforming their ability to convert strategic vision into tangible financial results and build resilient, future-proof enterprises.

Course Duration

10 days

Course Objectives

- Develop advanced skills in optimizing resource utilization across diverse organizational functions.

- Design and implement data-driven capital deployment strategies for maximum ROI.

- Deepen understanding of financial modeling, valuation techniques, and investment analysis.

- Ensure resource allocation decisions are meticulously aligned with overarching corporate strategy and business objectives.

- Implement effective risk management frameworks for capital projects and strategic initiatives.

- Foster an organizational culture capable of agile resource reallocation in response to market shifts.

- Utilize predictive analytics and scenario planning for superior resource and capital decisions.

- Conduct thorough feasibility studies and cost-benefit analysis for potential investments.

- Learn to construct and manage diversified investment portfolios for optimal returns.

- Establish key performance indicators (KPIs) to monitor and evaluate capital deployment effectiveness.

- Explore and apply resource management software and AI-driven tools for enhanced efficiency.

- Develop strategies for resource resilience and capital preservation in volatile economic environments.

- Integrate ESG (Environmental, Social, Governance) considerations into resource allocation and capital deployment decisions for long-term value creation.

Organizational Benefits

- Enhanced ability to identify and invest in high-return opportunities, leading to significant financial gains.

- Streamlined resource utilization, reducing waste and improving operational productivity across departments.

- Strategic deployment of capital into innovation, market expansion, and talent development drives sustainable organizational growth.

- Proactive identification and mitigation of financial and operational risks associated with resource and capital decisions.

- Agility in adapting to market changes and a strong focus on strategic investments provide a significant competitive edge.

- Better cash flow management, debt reduction, and overall financial stability.

- Clearer metrics and frameworks lead to improved accountability in resource and capital management.

- Deeper insights into resource capabilities and investment opportunities facilitate more effective long-term strategic planning.

Target Audience

- Senior Executives & C-Suite Leaders.

- Financial Directors & Managers.

- Project & Program Managers.

- Strategic Planning Professionals.

- Investment Analysts & Portfolio Managers.

- Business Development Managers.

- Entrepreneurs & Startup Founders.

- Consultants

Course Outline

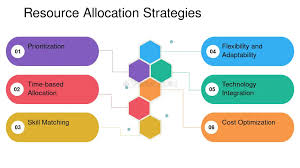

Module 1: Foundations of Strategic Resource Allocation

- Defining Strategic Resource Allocation: Concepts, principles, and its role in organizational success.

- Interplay between Strategy, Resources, and Capabilities.

- Types of Resources: Financial, Human, Physical, Intellectual, and Technological.

- Challenges and Common Pitfalls in Resource Allocation.

- Case Study: Netflix's Content Investment Strategy: How Netflix strategically allocated billions to original content, disrupting traditional media and building a global subscriber base.

Module 2: Economic Principles in Resource Allocation

- Opportunity Cost and Marginal Analysis in Decision-Making.

- Supply and Demand Dynamics in Resource Markets.

- Elasticity of Resource Supply and Demand.

- Economic Value Added (EVA) and Shareholder Value Creation.

- Case Study: Toyota's Lean Manufacturing: Analyzing how Toyota's focus on minimizing waste and optimizing resource flow revolutionized the automotive industry.

Module 3: Capital Budgeting and Investment Appraisal

- Overview of Capital Budgeting Techniques: NPV, IRR, Payback Period, Profitability Index.

- Advanced Valuation Methodologies: Discounted Cash Flow (DCF), Real Options.

- Cost of Capital: WACC, Cost of Equity, Cost of Debt.

- Sensitivity Analysis and Scenario Planning for Investment Decisions.

- Case Study: Amazon's Fulfillment Center Expansion: Examining Amazon's massive capital investments in logistics and technology to enhance efficiency and customer delivery.

Module 4: Financial Forecasting and Planning

- Techniques for Accurate Financial Forecasting: Trend Analysis, Regression, Econometric Models.

- Developing Integrated Financial Models (Income Statement, Balance Sheet, Cash Flow).

- Budgeting and Variance Analysis as Resource Control Mechanisms.

- Working Capital Management and its Impact on Capital Deployment.

- Case Study: Tesla's Gigafactory Investments: How Tesla's aggressive capital spending on large-scale manufacturing facilities supports its growth and innovation agenda.

Module 5: Risk Management in Capital Deployment

- Identifying and Assessing Financial Risks: Market Risk, Credit Risk, Operational Risk.

- Quantitative Risk Analysis Techniques: Monte Carlo Simulation, Value at Risk (VaR).

- Risk Mitigation Strategies for Capital Projects.

- Integrating Risk into Capital Allocation Decisions.

- Case Study: BP Deepwater Horizon Disaster: Analyzing the catastrophic consequences of inadequate risk assessment and capital allocation in large-scale energy projects.

Module 6: Portfolio Management and Diversification

- Principles of Portfolio Theory: Markowitz Model, CAPM.

- Asset Allocation Strategies: Strategic, Tactical, and Dynamic.

- Measuring Portfolio Performance: Sharpe Ratio, Treynor Ratio, Jensen's Alpha.

- Behavioral Finance Aspects in Investment Decisions.

- Case Study: Pension Fund Investment Strategies: How large institutional investors diversify their portfolios to manage risk and achieve long-term financial goals.

Module 7: Human Capital Allocation and Talent Management

- Strategic Workforce Planning and Talent Sourcing.

- Optimizing Human Capital Deployment for Key Initiatives.

- Measuring the ROI of Human Capital Investments.

- Addressing Skill Gaps and Future Workforce Needs.

- Case Study: Google's "20% Time" Policy: How allocating employee time for personal projects fostered innovation and new product development.

Module 8: Technology and Innovation Resource Allocation

- Allocating Resources for R&D and Innovation Pipelines.

- Evaluating Technology Investments: Build vs. Buy vs. Partner.

- Intellectual Property (IP) Management and Monetization.

- Digital Transformation and Resource Requirements.

- Case Study: Apple's R&D Investment in iPhone Development: The strategic allocation of vast resources to create groundbreaking consumer electronics.

Module 9: Mergers & Acquisitions (M&A) as Capital Deployment

- Strategic Rationale for M&A: Growth, Synergy, Market Consolidation.

- Due Diligence and Valuation in M&A Transactions.

- Integration Challenges and Post-Merger Resource Allocation.

- Financing M&A Deals: Debt, Equity, and Hybrid Structures.

- Case Study: Facebook's Acquisition of Instagram and WhatsApp: Analyzing how these strategic acquisitions deployed capital to secure market dominance and expand user base.

Module 10: Debt vs. Equity Financing Decisions

- Sources of Capital: Debt, Equity, and Hybrid Instruments.

- Capital Structure Theory: Modigliani-Miller, Trade-off Theory.

- Optimal Capital Structure and its Impact on Firm Value.

- Debt Covenants and Equity Dilution Considerations.

- Case Study: Startup Funding Rounds (Seed to IPO): Examining how startups strategically choose between debt and equity financing at different growth stages.

Module 11: Real Estate and Infrastructure Capital Deployment

- Investing in Physical Assets: Real Estate Development, Infrastructure Projects.

- Project Finance Models and Public-Private Partnerships (PPPs).

- Valuation of Real Assets and Returns on Investment.

- Sustainability and ESG Considerations in Real Estate and Infrastructure.

- Case Study: Dubai's Infrastructure Boom: How strategic capital deployment into world-class infrastructure transformed Dubai into a global hub.

Module 12: Advanced Resource Optimization Techniques

- Linear Programming and Optimization Algorithms for Resource Allocation.

- Simulation Modeling for Complex Resource Scenarios.

- Queuing Theory and Bottleneck Management.

- Lean Six Sigma Principles for Resource Efficiency.

- Case Study: Southwest Airlines' Operational Efficiency: How Southwest optimizes its resources (fleet, crew, gate time) to achieve industry-leading efficiency.

Module 13: Strategic Communication and Stakeholder Management

- Communicating Resource Allocation Decisions to Stakeholders.

- Managing Stakeholder Expectations and Conflicts.

- Building Consensus for Strategic Initiatives.

- Transparency and Accountability in Financial Reporting.

- Case Study: NASA's Apollo Program: The complex stakeholder management and communication strategies required to secure and deploy massive resources for the moon landing mission.

Module 14: Emerging Trends in Resource Allocation & Capital Deployment

- Impact of Artificial Intelligence (AI) and Machine Learning on Resource Optimization.

- Blockchain Technology for Transparent Capital Markets.

- Sustainable Finance and Green Investment Opportunities.

- The Gig Economy and Flexible Resource Models.

- Case Study: BlackRock's Integration of ESG into Investment Decisions: How a major asset manager is shifting capital towards sustainable investments.

Module 15: Developing an Integrated Strategic Resource & Capital Framework

- Designing a Comprehensive Resource Allocation Framework for Your Organization.

- Developing a Capital Deployment Playbook.

- Implementing a Continuous Improvement Cycle for Resource Management.

- Action Planning and Implementation Roadmap.

- Case Study: General Electric's Portfolio Restructuring: Analyzing GE's strategic decisions to divest non-core assets and reallocate capital to high-growth sectors.

Training Methodology

This course employs a highly interactive and practical training methodology, combining:

- Expert-Led Lectures: Engaging presentations from industry veterans and subject matter experts.

- Interactive Workshops: Hands-on exercises and group activities to apply theoretical concepts.

- Real-World Case Studies: In-depth analysis of successful and unsuccessful resource allocation and capital deployment scenarios.

- Group Discussions & Peer Learning: Opportunities to share experiences and best practices with fellow participants.

- Practical Tools & Templates: Provision of actionable tools and templates for immediate application in participants' organizations.

- Q&A Sessions: Dedicated time for addressing specific challenges and questions.

- Simulation Exercises: Experiential learning through simulated decision-making scenarios.

Register as a group from 3 participants for a Discount

Send us an email: info@datastatresearch.org or call +254724527104

Certification

Upon successful completion of this training, participants will be issued with a globally- recognized certificate.

Tailor-Made Course

We also offer tailor-made courses based on your needs.

Key Notes

a. The participant must be conversant with English.

b. Upon completion of training the participant will be issued with an Authorized Training Certificate

c. Course duration is flexible and the contents can be modified to fit any number of days.

d. The course fee includes facilitation training materials, 2 coffee breaks, buffet lunch and A Certificate upon successful completion of Training.

e. One-year post-training suppo