Training course on Stochastic Modeling for Pension Liabilities

Training Course on Stochastic Modeling for Pension Liabilities is designed to provide professionals with a comprehensive understanding of stochastic modeling techniques and their applications in estimating and managing pension liabilities.

Course Overview

Training Course on Stochastic Modeling for Pension Liabilities

Introduction

Training Course on Stochastic Modeling for Pension Liabilities is designed to provide professionals with a comprehensive understanding of stochastic modeling techniques and their applications in estimating and managing pension liabilities. As pension funds face increasing uncertainties related to market conditions, interest rates, and demographic changes, the ability to employ stochastic models becomes essential for effective risk management and financial planning. This course focuses on the principles and methodologies of stochastic modeling, enabling participants to develop robust models that enhance decision-making and forecasting accuracy.

Participants will explore key topics such as model formulation, risk assessment, scenario analysis, and regulatory considerations. The curriculum integrates theoretical concepts with practical applications, featuring hands-on exercises, case studies, and software tools that allow attendees to engage with real-world scenarios. By the end of the training, participants will be well-prepared to implement stochastic modeling techniques that provide deeper insights into pension liabilities and help manage the associated risks. This comprehensive approach aims to empower professionals to navigate the complexities of pension liability modeling in today's dynamic financial landscape.

Course Objectives

- Understand the fundamentals of stochastic modeling in pension liabilities.

- Analyze the benefits and limitations of stochastic models.

- Evaluate different stochastic modeling techniques and approaches.

- Explore the role of assumptions in model formulation.

- Assess the impact of market volatility on pension liabilities.

- Conduct scenario analysis and stress testing using stochastic models.

- Discuss regulatory frameworks affecting stochastic modeling.

- Develop skills in using software for stochastic modeling.

- Foster collaboration among actuaries, financial analysts, and risk managers.

- Create actionable plans for implementing stochastic modeling techniques.

- Stay informed about emerging trends in stochastic modeling.

- Measure the effectiveness of stochastic models in pension liability management.

- Build techniques for measuring present value and future obligations

Target Audience

- Actuaries and actuarial analysts

- Pension fund managers

- Risk management professionals

- Financial analysts and consultants

- Compliance officers

- Graduate students in finance or actuarial science

- Corporate finance professionals

- Investment strategists

Course Duration: 10 Days

Course Modules

Module 1: Introduction to Stochastic Modeling

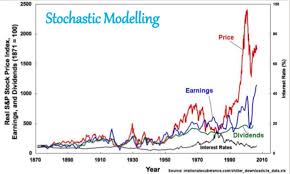

- Overview of stochastic modeling concepts and principles.

- Importance of stochastic modeling in pension liability management.

- Key terminology and definitions related to stochastic processes.

- Historical context and evolution of stochastic modeling in finance.

- Case studies illustrating the application of stochastic models.

Module 2: Fundamentals of Pension Liabilities

- Understanding pension liabilities and their components.

- Techniques for measuring present value and future obligations.

- Factors influencing pension liabilities (demographics, interest rates).

- Real-world examples of pension liability calculations.

- Introduction to liability valuation methods.

Module 3: Stochastic Processes and Their Applications

- Overview of stochastic processes relevant to pension modeling.

- Introduction to random variables and probability distributions.

- Techniques for simulating stochastic processes.

- Understanding Markov processes and their applications.

- Case studies on stochastic process applications in pensions.

Module 4: Model Formulation and Assumptions

- Steps for formulating stochastic models for pension liabilities.

- Importance of assumptions in model development.

- Evaluating the impact of different assumptions on outcomes.

- Techniques for sensitivity analysis in model assumptions.

- Real-life examples of model formulation challenges.

Module 5: Market Risk and Pension Liabilities

- Understanding the relationship between market risk and pension liabilities.

- Techniques for modeling interest rate risk and equity risk.

- Assessing the impact of market volatility on funding levels.

- Developing risk management strategies for market risks.

- Case studies on market risk management in pension funds.

Module 6: Scenario Analysis and Stress Testing

- Importance of scenario analysis in risk management.

- Techniques for developing and implementing stress tests.

- Evaluating the impact of extreme scenarios on pension liabilities.

- Developing actionable insights from scenario analysis results.

- Real-world examples of scenario analysis applications.

Module 7: Regulatory Frameworks and Compliance

- Overview of regulations affecting stochastic modeling in pensions.

- Key legislation impacting pension fund management.

- Understanding compliance requirements for stochastic models.

- Engaging with regulators on modeling issues.

- Case studies on regulatory challenges and solutions.

Module 8: Software Tools for Stochastic Modeling

- Overview of software applications used in stochastic modeling.

- Techniques for using Excel, R, Python, and other tools for simulations.

- Hands-on exercises with stochastic modeling software.

- Understanding data management and integration in modeling.

- Real-world examples of software applications in pensions.

Module 9: Model Validation and Backtesting

- Importance of model validation in stochastic modeling.

- Techniques for conducting backtests and analyzing results.

- Understanding model performance metrics and evaluation.

- Developing frameworks for continuous model improvement.

- Case studies on validation practices in pension modeling.

Module 10: Collaboration and Communication in Stochastic Modeling

- Importance of collaboration among actuaries, analysts, and stakeholders.

- Techniques for effectively communicating modeling results.

- Best practices for engaging with clients and trustees on stochastic models.

- Developing tools and resources for effective communication.

- Real-world examples of successful collaboration in modeling.

Module 11: Emerging Trends in Stochastic Modeling

- Exploring innovations in stochastic modeling techniques and tools.

- Impact of technology and data analytics on modeling practices.

- Discussing trends in regulatory changes and their implications.

- Preparing for the future of stochastic modeling in pensions.

- Case studies on cutting-edge advancements in modeling.

Module 12: Implementing Stochastic Modeling Techniques

- Steps for developing a comprehensive stochastic modeling strategy.

- Engaging teams and stakeholders in the implementation process.

- Setting measurable objectives and timelines for modeling initiatives.

- Monitoring and adapting stochastic models over time.

- Presenting modeling results and plans to stakeholders for approval.

Training Methodology

- Interactive Workshops: Facilitated discussions, group exercises, and problem-solving activities.

- Case Studies: Real-world examples to illustrate successful community-based surveillance practices.

- Role-Playing and Simulations: Practice engaging communities in surveillance activities.

- Expert Presentations: Insights from experienced public health professionals and community leaders.

- Group Projects: Collaborative development of community surveillance plans.

- Action Planning: Development of personalized action plans for implementing community-based surveillance.

- Digital Tools and Resources: Utilization of online platforms for collaboration and learning.

- Peer-to-Peer Learning: Sharing experiences and insights on community engagement.

- Post-Training Support: Access to online forums, mentorship, and continued learning resources.

Register as a group from 3 participants for a Discount

Send us an email: info@datastatresearch.org or call +254724527104

Certification

Upon successful completion of this training, participants will be issued with a globally recognized certificate.

Tailor-Made Course

We also offer tailor-made courses based on your needs.

Key Notes

- Participants must be conversant in English.

- Upon completion of training, participants will receive an Authorized Training Certificate.

- The course duration is flexible and can be modified to fit any number of days.

- Course fee includes facilitation, training materials, 2 coffee breaks, buffet lunch, and a Certificate upon successful completion.

- One-year post-training support, consultation, and coaching provided after the course.

- Payment should be made at least a week before the training commencement to DATASTAT CONSULTANCY LTD account, as indicated in the invoice, to enable better preparation.