Training course on Social Protection Fund Governance and Accountability

Training Course on Social Protection Fund Governance and Accountability is meticulously designed to equip senior policymakers, social protection program managers, public financial management specialists, fund administrators, financial regulators, internal and external auditors, civil society organizations, beneficiary representatives, and development partners with the expert knowledge and practical methodologies to strategically design, implement, and strengthen governance and accountability systems for social protection funds.

Course Overview

Training Course on Social Protection Fund Governance and Accountability

Introduction

The integrity and effectiveness of social protection systems fundamentally depend on robust governance and accountability frameworks. As countries increasingly invest in social protection to reduce poverty, build resilience, and promote inclusive growth, ensuring that funds are managed efficiently, transparently, and equitably becomes paramount. Social Protection Fund Governance and Accountability encompasses the structures, processes, and mechanisms that ensure sound decision-making, responsible resource management, adherence to legal frameworks, and responsiveness to the needs of beneficiaries and citizens. Without strong governance, social protection funds are vulnerable to mismanagement, corruption, political interference, and inefficiency, undermining public trust and ultimately failing to deliver their intended impact, especially in contexts like Kenya with its commitment to a comprehensive social protection policy. Training Course on Social Protection Fund Governance and Accountability is meticulously designed to equip senior policymakers, social protection program managers, public financial management specialists, fund administrators, financial regulators, internal and external auditors, civil society organizations, beneficiary representatives, and development partners with the expert knowledge and practical methodologies to strategically design, implement, and strengthen governance and accountability systems for social protection funds. The program focuses on institutional arrangements, legal and regulatory frameworks, financial oversight, risk management, internal controls, external audit, grievance redress mechanisms, social accountability tools, and the role of oversight bodies, blending rigorous analytical frameworks with practical, hands-on application, extensive global case studies (including deep dives into successful and challenging African experiences), and intensive policy simulation and design exercises. Participants will gain the strategic foresight and technical expertise to confidently promote transparency, prevent fraud, ensure responsible fund stewardship, and enhance the responsiveness of social protection systems, thereby securing their position as indispensable leaders in building trustworthy and impactful social protection.

This intensive 5-day program delves into nuanced methodologies for assessing existing governance gaps in social protection funds, mastering sophisticated techniques for designing fit-for-purpose institutional arrangements (e.g., governing boards, investment committees), and exploring cutting-edge approaches to establishing robust internal control systems, developing comprehensive risk management frameworks, fostering transparent financial reporting, leveraging digital technologies for enhanced oversight, and empowering citizens through effective social accountability mechanisms. A significant focus will be placed on understanding the interplay of fund governance with national anti-corruption strategies and public procurement regulations, the specific challenges of ensuring accountability in fragmented social protection systems and informal economies, and the practical application of ethical leadership and stakeholder engagement strategies to build consensus and drive reform. By integrating global industry best practices in pension fund governance, public sector financial management, and human rights-based approaches to social protection (drawing examples from pioneering reforms in Latin America, Asia, and in-depth analyses of Kenya's National Social Protection Policy and related oversight bodies), analyzing **real-world examples of governance successes and failures from various countries, and engaging in intensive hands-on governance risk assessments, audit simulation exercises, grievance redress mechanism design, and expert-led discussions on fostering a culture of integrity, attendees will develop the strategic acumen to confidently lead and participate in governance reforms, ensuring that social protection funds are not only fiscally sound but also ethically managed and genuinely responsive to the needs of their beneficiaries, thereby securing their position as indispensable leaders in securing social justice through robust financial stewardship.

Course Objectives:

Upon completion of this course, participants will be able to:

- Analyze core concepts and strategic responsibilities of Governance and Accountability within the context of Social Protection Funds.

- Master sophisticated techniques for designing appropriate institutional arrangements for effective social protection fund management.

- Develop robust methodologies for establishing comprehensive legal and regulatory frameworks that ensure sound fund governance.

- Implement effective strategies for strengthening financial oversight, internal controls, and risk management within social protection funds.

- Manage complex considerations for conducting independent audits (financial and performance) and ensuring timely follow-up on audit recommendations.

- Apply robust strategies for enhancing transparency and public disclosure of social protection fund operations and financial performance.

- Understand the deep integration of grievance redress mechanisms (GRMs) as a vital accountability tool for social protection beneficiaries.

- Leverage knowledge of global best practices and lessons learned from countries that have successfully implemented strong social protection fund governance, with a special focus on African experiences and pension fund models.

- Optimize strategies for promoting social accountability and citizen participation in the oversight of social protection funds.

- Formulate specialized recommendations for addressing challenges such as political interference, corruption, capacity constraints, and data limitations in fund governance.

- Conduct comprehensive assessments of the ethical considerations and conflicts of interest in social protection fund management.

- Navigate challenging situations related to ensuring accountability in fragmented social protection systems and managing funds for the informal economy.

- Develop a holistic, evidence-based, and politically astute approach to Social Protection Fund Governance and Accountability, fostering public trust and sustainable impact.

Target Audience:

This course is designed for professionals interested in Social Protection Fund Governance and Accountability:

- Policymakers & Senior Government Officials: From Ministries of Social Protection, Finance, Planning, and relevant line ministries.

- Social Protection Program Managers & Administrators: Responsible for the day-to-day management and oversight of social protection programs and their funds.

- Public Financial Management (PFM) Specialists & Budget Officers: Involved in the budgeting, allocation, and tracking of social protection expenditures.

- Financial Regulators & Supervisors: From central banks or financial regulatory authorities overseeing social security institutions or pension funds.

- Internal and External Auditors: Responsible for auditing social protection funds and programs.

- Civil Society Organizations (CSOs) & Beneficiary Advocates: Engaged in monitoring, advocacy, and promoting social accountability.6

- Board Members & Trustees: Of social security institutions, pension funds, or social protection fund management bodies.

- Development Partners & International Organizations: Supporting governance reforms and social protection initiatives.

Course Duration: 5 Days

Course Modules:

- Module 1: Foundations of Governance and Accountability in Social Protection (Day 1)

- Defining good governance in the public sector: Principles, pillars, and frameworks.

- The unique governance challenges and opportunities for social protection funds.

- Understanding accountability: Types (political, administrative, fiscal, social) and mechanisms.

- The importance of transparency, integrity, and ethical conduct in social protection.

- The human rights-based approach to social protection and the right to accountability.

- Module 2: Institutional and Legal Frameworks for Fund Governance (Day 1)

- Roles and responsibilities of governing boards, investment committees, and management teams.

- Legal status of social protection funds (e.g., statutory bodies, dedicated accounts).

- Legislative and regulatory requirements for fund establishment, management, and oversight.

- Distinguishing between governance of contributory (social security/pension) and non-contributory (social assistance) funds.

- Case studies of institutional models (e.g., parastatal, ministerial department, independent agency).

- Module 3: Financial Management and Oversight (Day 2)

- Budgeting and financial planning for social protection funds.

- Sound financial reporting standards and practices (e.g., IPSAS).

- Establishing robust internal control systems to prevent fraud and errors.7

- Treasury management, cash flow forecasting, and investment guidelines for reserves.

- Risk management frameworks: Identifying, assessing, and mitigating financial, operational, and reputational risks.

- Module 4: Internal and External Audit, and Oversight Bodies (Day 2)

- Role and functions of internal audit in social protection funds.

- The mandate and independence of supreme audit institutions (SAIs) in external audit.

- Performance audits: Assessing efficiency and effectiveness of social protection spending.8

- Parliamentary oversight: Budget approval, legislative scrutiny, and committee hearings.

- Ensuring timely follow-up and implementation of audit recommendations.

- Module 5: Transparency and Public Disclosure (Day 3)

- Importance of proactive disclosure of information: Budget details, beneficiary data (aggregated), performance reports, audit findings.

- Accessible formats for public information: Websites, public hearings, simplified reports.

- Freedom of Information (FOI) laws and their application to social protection funds.

- Balancing transparency with data privacy and security considerations.

- Leveraging digital platforms for enhanced transparency (e.g., online dashboards).

- Module 6: Grievance Redress Mechanisms (GRMs) for Beneficiaries (Day 3)

- Designing effective, accessible, and inclusive GRMs for social protection programs.

- Key principles: Fairness, impartiality, responsiveness, proportionality, and confidentiality.

- Channels for complaint submission (hotlines, online, in-person, mobile).9

- Case management systems for tracking complaints to resolution.

- Linking GRMs to broader accountability and learning processes.

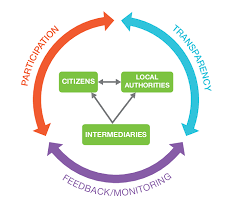

- Module 7: Social Accountability and Citizen Participation (Day 4)

- Definition and tools of social accountability: Community scorecards, citizen report cards, social audits, participatory budgeting.

- Empowering beneficiaries and civil society to monitor fund performance and service delivery.

- The role of media and investigative journalism in enhancing accountability.

- Strategies for building trust and fostering collaboration between state and non-state actors.

- Addressing elite capture and power imbalances in participatory processes.

- Module 8: Addressing Governance Challenges in Developing Contexts (Day 4)

- Challenges: Capacity gaps, fragmentation of systems, political interference, corruption risks, informal economy.

- Strategies for strengthening institutional capacity and human resources.

- Mitigating risks of corruption and leakage in fund management and benefit delivery.

- Ensuring accountability in decentralized social protection systems.

- Navigating the political economy of governance reforms.

- Module 9: Ethics, Conflicts of Interest, and Professionalism (Day 5)

- Ethical principles for social protection fund management and staff.

- Identifying, disclosing, and managing conflicts of interest for board members and employees.10

- Codes of conduct and anti-corruption policies.

- Building a culture of integrity and professionalism within social protection institutions.

- Whistleblower protection and mechanisms for reporting wrongdoing.

- Module 10: Case Studies and Lessons Learned (Day 5)

- In-depth analysis of governance successes and failures from various countries across continents.

- Focus on Kenya's National Social Protection Policy, the role of different agencies, and ongoing governance efforts.

- Lessons from pension fund governance (e.g., Kenya's RBA guidance) applicable to broader social protection funds.

- Discussions on how specific governance reforms led to improved outcomes or failed to do so.

- Identifying transferable best practices and contextual adaptations.

Training Methodology

- Interactive Workshops: Facilitated discussions, group exercises, and problem-solving activities.

- Case Studies: Real-world examples to illustrate successful community-based surveillance practices.

- Role-Playing and Simulations: Practice engaging communities in surveillance activities.

- Expert Presentations: Insights from experienced public health professionals and community leaders.

- Group Projects: Collaborative development of community surveillance plans.

- Action Planning: Development of personalized action plans for implementing community-based surveillance.

- Digital Tools and Resources: Utilization of online platforms for collaboration and learning.

- Peer-to-Peer Learning: