Training Course on Risk-Based Auditing

Training Course on Risk-Based Auditing is designed to equip auditors with the necessary skills and knowledge to implement risk-based auditing techniques effectively, ensuring that resources are utilized in areas where risk is highest.

Course Overview

Training Course on Risk-Based Auditing

Introduction

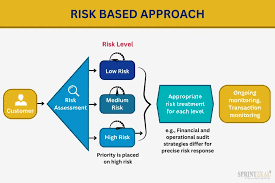

Risk-Based Auditing (RBA) is a strategic approach to auditing that focuses on identifying and mitigating risks that may affect an organization's financial integrity, operational performance, and compliance obligations. This course is designed to equip auditors with the necessary skills and knowledge to implement risk-based auditing techniques effectively, ensuring that resources are utilized in areas where risk is highest. By focusing on risk assessments and controls, Risk-Based Auditing empowers auditors to prioritize auditing efforts, providing critical insights that protect the organization's reputation and financial stability.

As businesses face an increasingly complex risk environment, the need for auditors to be proactive rather than reactive is paramount. Risk-Based Auditing emphasizes the importance of analyzing risks systematically and conducting audits based on those assessments. This course covers best practices in audit planning, risk identification, risk mitigation, and internal control frameworks, ensuring auditors are well-prepared to navigate evolving challenges. Participants will learn how to apply cutting-edge tools, techniques, and methodologies to enhance audit effectiveness and deliver value-added results.

Course Duration

10 days

Course Objectives

- Understand the fundamentals of Risk-Based Auditing and its significance in modern audits.

- Learn how to identify and assess risks to prioritize audit efforts effectively.

- Master the techniques for evaluating the effectiveness of internal controls and risk management frameworks.

- Gain proficiency in using data analytics for risk assessment and audit planning.

- Develop strategies for designing audit programs that focus on high-risk areas.

- Enhance the ability to communicate audit findings to management and stakeholders.

- Implement audit strategies that align with organizational goals and risk appetite.

- Strengthen knowledge of compliance frameworks and how they relate to audit processes.

- Learn the use of risk models and tools in performing audits across diverse sectors.

- Explore advanced methodologies for assessing financial, operational, and compliance risks.

- Increase competency in managing audits in dynamic regulatory environments.

- Build proficiency in post-audit analysis and follow-up procedures to ensure risk mitigation.

- Understand the role of continuous monitoring and real-time audits in mitigating emerging risks.

Organizational Benefits

- Improved allocation of audit resources to areas of highest risk.

- Enhanced understanding of the organization's key risks and opportunities.

- Increased effectiveness of the internal audit function in achieving organizational goals.

- Proactive identification of potential weaknesses and opportunities for improvement.

- Stronger alignment between internal audit activities and overall risk management efforts.

- Enhanced communication and collaboration between internal audit and management.

- Increased confidence of stakeholders in the organization's governance and control processes.

- Greater agility and responsiveness to emerging risks and changes in the business environment.

Target Participants

- Internal Auditors

- External Auditors

- Risk Management Professionals

- Compliance Officers

- Financial Analysts

- Corporate Governance Specialists

- Audit Managers and Supervisors

- Business Executives and Managers

Course Outline

1: Introduction to Risk-Based Auditing

- Overview of Risk-Based Auditing (RBA)

- Key Principles of RBA

- Benefits of RBA in Modern Audits

- Comparison: Traditional Auditing vs. Risk-Based Auditing

- Key Components of a Risk-Based Audit

2: Understanding Risk in Auditing

- Types of Risks in Auditing

- Risk Identification Methods

- Techniques for Risk Assessment

- Risk Appetite and Tolerance in Auditing

- Documenting and Prioritizing Risks

3: Audit Planning and Preparation

- Steps in Risk-Based Audit Planning

- Identifying High-Risk Areas

- Setting Audit Objectives

- Resource Allocation Based on Risk

- Developing an Audit Plan for Risk-Based Audits

4: Evaluating Internal Controls

- Understanding Internal Control Frameworks

- Risk-Based Approach to Control Evaluation

- Testing the Effectiveness of Controls

- Identifying Gaps in Internal Controls

- Reporting on Internal Control Deficiencies

5: Data Analytics in Risk-Based Auditing

- Introduction to Data Analytics in Auditing

- Using Data to Identify Risks

- Data Visualization Techniques

- Statistical Methods for Risk Assessment

- Integrating Data Analytics in Audit Planning

6: Financial Risk Management

- Types of Financial Risks in Audits

- Identifying and Mitigating Financial Risks

- Tools for Financial Risk Assessment

- Financial Statement Auditing and Risk-Based Techniques

- Managing Financial Risks in Audits

7: Compliance Risk Auditing

- Understanding Compliance Frameworks

- Risk-Based Approach to Compliance Auditing

- Regulatory and Legal Risks

- Assessing Compliance Gaps

- Designing Compliance Audit Programs

8: Operational Risk Auditing

- Identifying Operational Risks in Auditing

- Risk-Based Auditing of Operations and Processes

- Improving Efficiency Through Operational Audits

- Tools and Techniques for Operational Risk Assessment

- Best Practices for Operational Auditing

9: Reporting and Communication of Audit Findings

- Communicating Risks to Management

- Writing Effective Audit Reports

- Risk Reporting to Stakeholders

- Creating Actionable Recommendations

- Presenting Findings to Executive Management

10: Risk Mitigation Strategies

- Identifying Risk Mitigation Techniques

- Designing Risk Mitigation Action Plans

- Implementing Corrective Actions

- Monitoring Risk Mitigation Effectiveness

- Reporting on Risk Mitigation Progress

11: Auditing in a Regulatory Environment

- Navigating Regulatory Risks

- Global Standards in Risk-Based Auditing

- Impact of Regulatory Changes on Audits

- Managing Audits in Multi-Jurisdictional Environments

- Ensuring Compliance with International Standards

12: Continuous Monitoring and Real-Time Audits

- Importance of Continuous Monitoring in Auditing

- Techniques for Real-Time Risk Assessment

- Tools for Continuous Audit Monitoring

- Managing Dynamic Risk Environments

- Best Practices in Real-Time Audit Methodology

13: Post-Audit Analysis and Follow-up

- Reviewing Audit Outcomes

- Post-Audit Risk Mitigation Strategies

- Best Practices in Follow-up Procedures

- Tracking Audit Implementation

- Closing the Audit Loop

14: Advanced Risk Assessment Methodologies

- Advanced Techniques in Risk Identification

- Scenario Analysis and Stress Testing

- Qualitative vs. Quantitative Risk Assessment

- Predictive Analytics in Auditing

- Using Artificial Intelligence for Risk Analysis

15: Future Trends in Risk-Based Auditing

- Emerging Risks in Auditing

- Impact of Technology on Risk Auditing

- The Future of Risk-Based Auditing in Global Organizations

- Trends in Compliance and Governance

- Preparing for the Next Generation of Auditors

Training Methodology

- Interactive Lectures and Presentations: Delivering core concepts and principles with real-world examples.

- Case Studies and Group Discussions: Applying learned concepts to practical scenarios and fostering peer learning.

- Practical Exercises and Simulations: Providing hands-on experience in risk assessment, audit planning, and reporting.

- Role-Playing Activities: Simulating audit interactions and communication scenarios.

- Use of Templates and Tools: Providing practical resources for implementing Risk-Based Auditing.

Register as a group from 3 participants for a Discount

Send us an email: info@datastatresearch.org or call +254724527104

Certification

Upon successful completion of this training, participants will be issued with a globally- recognized certificate.

Tailor-Made Course

We also offer tailor-made courses based on your needs.

Key Notes

a. The participant must be conversant with English.

b. Upon completion of training the participant will be issued with an Authorized Training Certificate

c. Course duration is flexible and the contents can be modified to fit any number of days.

d. The course fee includes facilitation training materials, 2 coffee breaks, buffet lunch and A Certificate upon successful completion of Training.

e. One-year post-training support Consultation and Coaching provided after the course.

f. Payment should be done at least a week before commence of the training, to DATASTAT CONSULTANCY LTD account, as indicated in the invoice so as to enable us prepare better for you