Training course on Cost-Benefit Analysis of Social Protection Interventions

Training Course on Cost-Benefit Analysis of Social Protection Interventions is meticulously designed to equip with the advanced theoretical insights and intensive practical tools necessary to excel

Skills Covered

Course Overview

Training Course on Cost-Benefit Analysis of Social Protection Interventions

Introduction

Cost-Benefit Analysis (CBA) of Social Protection Interventions is a vital analytical tool for optimizing resource allocation and demonstrating the efficiency of programs designed to reduce poverty, vulnerability, and inequality. In an environment of increasing demand for social protection and often limited public budgets, decision-makers face critical choices about which interventions to fund and scale. CBA provides a systematic framework for comparing the total monetary value of benefits against the total monetary value of costs, enabling policymakers to identify interventions that yield the greatest net social welfare. This course moves beyond simply measuring impact to rigorously assessing the "value for money" of interventions, ensuring that investments in social protection yield the greatest possible social returns.

Training Course on Cost-Benefit Analysis of Social Protection Interventions is meticulously designed to equip with the advanced theoretical insights and intensive practical tools necessary to excel in Cost-Benefit Analysis of Social Protection Interventions. We will delve into the foundational concepts of economic evaluation, master the intricacies of identifying, measuring, and valuing both tangible and intangible costs and benefits, and explore cutting-edge approaches to conducting CBA, sensitivity analysis, and presenting findings. A significant focus will be placed on hands-on application using real-world social protection programs, interpreting complex results, and effectively communicating findings to inform resource allocation decisions. By integrating industry best practices, analyzing complex case studies, and engaging in intensive practical exercises, attendees will develop the strategic acumen to confidently lead and implement rigorous CBA, fostering unparalleled efficiency, accountability, and evidence-informed resource allocation in social protection.

Course Objectives

Upon completion of this course, participants will be able to:

- Analyze the fundamental concepts of economic evaluation and the specific role of Cost-Benefit Analysis (CBA).

- Comprehend the strategic importance of CBA for optimizing resource allocation in social protection.

- Master methodologies for identifying and measuring all relevant costs of social protection interventions.

- Develop expertise in identifying and valuing tangible benefits of social protection programs.

- Formulate strategies for valuing intangible and non-market benefits in monetary terms.

- Understand the critical role of discounting and inflation adjustments in CBA.

- Implement robust approaches to calculating Net Present Value (NPV) and Benefit-Cost Ratios (BCR).

- Explore key strategies for conducting sensitivity analysis and uncertainty assessment in CBA.

- Apply methodologies for comparing different social protection interventions using CBA.

- Understand and address ethical considerations and distributional impacts in CBA.

- Develop preliminary skills in using software tools for CBA (e.g., Excel, specialized models).

- Conduct a full Cost-Benefit Analysis of a social protection program.

- Examine global best practices and lessons learned in CBA for social protection.

Target Audience

This course is essential for professionals involved in the economic aspects of social protection:

- Social Protection Policymakers: Making decisions on program funding and design.

- Program Managers & Coordinators: Overseeing program budgets and efficiency.

- Economists & Public Finance Experts: Analyzing government spending and social investments.

- M&E Specialists: Integrating economic evaluation into impact assessments.

- Government Officials: From ministries of finance, planning, and social welfare.

- Development Practitioners: From NGOs and international organizations.

- Researchers & Academics: Conducting economic evaluations of social programs.

- Budget Officers: Allocating resources for social protection.

Course Duration: 10 Days

Course Modules

Module 1: Foundations of Economic Evaluation in Social Protection

- Define economic evaluation and its different types (CBA, CEA, CUA).

- Understand the specific purpose and application of Cost-Benefit Analysis (CBA).

- Discuss the importance of economic evaluation for resource allocation decisions.

- Explore the conceptual framework of efficiency and welfare economics in social protection.

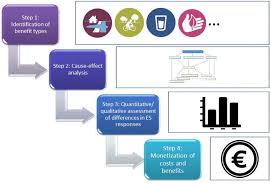

- Identify the key steps in conducting any economic evaluation.

Module 2: Identifying and Measuring Program Costs

- Master methodologies for systematically identifying all relevant costs.

- Differentiate between direct and indirect costs, fixed and variable costs.

- Learn to collect cost data from various sources (administrative records, financial reports).

- Understand how to value different types of costs (e.g., personnel, materials, overheads).

- Practice categorizing and aggregating program costs for CBA.

Module 3: Identifying and Valuing Tangible Benefits

- Develop expertise in identifying and measuring tangible benefits of social protection.

- Understand benefits that can be directly observed and monetized (e.g., increased income, reduced healthcare costs).

- Discuss methods for collecting data on tangible benefits.

- Explore how to attribute benefits to the social protection intervention.

- Practice identifying and quantifying tangible benefits for a program.

Module 4: Valuing Intangible and Non-Market Benefits

- Formulate strategies for valuing intangible and non-market benefits in monetary terms.

- Understand the challenges of valuing concepts like improved well-being, reduced stress, social cohesion.

- Learn about stated preference methods (e.g., contingent valuation, choice modeling).

- Explore revealed preference methods (e.g., hedonic pricing, travel cost method).

- Practice applying valuation techniques to non-market benefits.

Module 5: Discounting and Inflation Adjustment

- Understand the critical role of discounting in economic evaluation.

- Learn to apply discount rates to future costs and benefits.

- Discuss the rationale for discounting in social protection and public policy.

- Explore methods for adjusting costs and outcomes for inflation.

- Practice calculating present values of future costs and benefits.

Module 6: Calculating Net Present Value (NPV) and Benefit-Cost Ratios (BCR)

- Implement robust approaches to calculating key CBA metrics.

- Learn to calculate the Net Present Value (NPV) of a social protection intervention.

- Understand the calculation and interpretation of the Benefit-Cost Ratio (BCR).

- Discuss the decision rules for accepting or rejecting projects based on NPV and BCR.

- Practice calculating NPV and BCR for different scenarios.

Module 7: Sensitivity Analysis and Uncertainty Assessment

- Explore key strategies for conducting sensitivity analysis in CBA.

- Understand the importance of testing assumptions and varying parameters.

- Learn to conduct one-way, multi-way, and probabilistic sensitivity analyses.

- Discuss Monte Carlo simulations and scenario analysis for uncertainty.

- Practice performing sensitivity analysis using software (e.g., Excel).

Module 8: Comparing Interventions and Decision-Making

- Apply methodologies for comparing multiple social protection interventions using CBA.

- Understand how CBA informs resource allocation and prioritization decisions.

- Discuss the use of CBA for program design choices and scale-up decisions.

- Explore the role of CBA in informing investment cases for social protection.

- Analyze case studies of CBA informing policy choices.

Module 9: Ethical Considerations and Distributional Impacts

- Understand and address ethical considerations in economic evaluation.

- Discuss the tension between efficiency and equity in social protection.

- Explore how CBA can account for distributional impacts (e.g., who benefits, who pays).

- Learn to ensure transparency and avoid bias in CBA.

- Analyze ethical dilemmas encountered in real-world CBAs.

Module 10: Software Tools for CBA and Practical Application

- Develop preliminary skills in using software tools for CBA.

- Gain hands-on experience with Excel for setting up CBA models.

- Explore specialized software or templates for economic evaluation.

- Conduct a full, hands-on Cost-Benefit Analysis of a social protection program using real or simulated data.

- Present the findings and discuss their policy implications.

Module 11: Beyond CBA: Introduction to Cost-Effectiveness Analysis (CEA)

- Differentiate CBA from Cost-Effectiveness Analysis (CEA).

- Understand when CEA is more appropriate than CBA.

- Learn to calculate the Incremental Cost-Effectiveness Ratio (ICER).

- Discuss the use of CEA for comparing interventions with similar outcomes.

- Explore the strengths and limitations of CEA in social protection.

Module 12: Communicating CBA Results and Advocacy

- Master the art of communicating complex CBA results to diverse audiences.

- Learn to translate technical findings into clear and compelling policy messages.

- Discuss strategies for presenting CBA results in reports, briefs, and presentations.

- Explore the role of CBA in advocacy for social protection investments.

- Examine global best practices in communicating economic evaluation findings.

Training Methodology

- Interactive Workshops: Facilitated discussions, group exercises, and problem-solving activities.

- Case Studies: Real-world examples to illustrate successful community-based surveillance practices.

- Role-Playing and Simulations: Practice engaging communities in surveillance activities.

- Expert Presentations: Insights from experienced public health professionals and community leaders.

- Group Projects: Collaborative development of community surveillance plans.

- Action Planning: Development of personalized action plans for implementing community-based surveillance.

- Digital Tools and Resources: Utilization of online platforms for collaboration and learning.

- Peer-to-Peer Learning: Sharing experiences and insights on community engagement.

- Post-Training Support: Access to online forums, mentorship, and continued learning resources.

Register as a group from 3 participants for a Discount

Send us an email: info@datastatresearch.org or call +254724527104

Certification

Upon successful completion of this training, participants will be issued with a globally recognized certificate.

Tailor-Made Course

We also offer tailor-made courses based on your needs.

Key Notes

- Participants must be conversant in English.

- Upon completion of training, participants will receive an Authorized Training Certificate.

- The course duration is flexible and can be modified to fit any number of days.

- Course fee includes facilitation, training materials, 2 coffee breaks, buffet lunch, and a Certificate upon successful completion.

- One-year post-training support, consultation, and coaching provided after the course.

- Payment should be made at least a week before the training commencement to DATASTAT CONSULTANCY LTD account, as indicated in the invoice, to enable better preparation.