Training course on Advanced Social Protection Financing Strategies

Training Course on Advanced Social Protection Financing Strategies is designed to equip with the expert knowledge and practical methodologies

Course Overview

Training Course on Advanced Social Protection Financing Strategies

Introduction:

The global imperative to expand social protection coverage and adequacy, especially in the face of persistent poverty, rising inequalities, and increasing vulnerability to economic shocks, climate change, and health crises, hinges critically on the availability of sustainable and equitable financing. Training Course on Advanced Social Protection Financing Strategies is designed to equip with the expert knowledge and practical methodologies to strategically analyze, design, and implement advanced financing strategies for sustainable social protection systems. The program focuses on comprehensive fiscal space analysis, innovative domestic revenue mobilization, strategic expenditure re-allocation, the political economy of financing reforms, shock-responsive financing, role of international cooperation, new financial instruments, and long-term financial sustainability and actuarial analysis, blending rigorous analytical frameworks with practical, hands-on application, global case studies (with a strong emphasis on African contexts, including Kenya), and intensive fiscal modeling and financing roadmap development exercises. Participants will gain the strategic foresight and technical expertise to confidently identify and unlock sustainable financing for expanding social protection, fostering unparalleled financial resilience, equitable coverage, and transformative impact, thereby securing their position as indispensable leaders in securing the financial bedrock of inclusive development.

This comprehensive 10-day program delves into nuanced methodologies for conducting in-depth fiscal space assessments considering macroeconomic indicators and debt sustainability, mastering sophisticated techniques for evaluating the progressivity and revenue potential of various tax reforms, particularly in contexts with large informal sectors like Kenya, and exploring cutting-edge approaches to designing multi-layered financing strategies that combine domestic resources, risk transfer mechanisms, and international support, leveraging digital financial services for cost-efficient disbursements, and applying actuarial principles to ensure the long-term solvency of contributory schemes. A significant focus will be placed on understanding the interplay of social protection financing with broader public finance management (PFM) reforms, the specific challenges of financing universal social protection floors in contexts with large informal economies and limited tax bases (as observed in many African countries, including Kenya), and the practical application of political economy analysis to navigate reform processes and build consensus among diverse stakeholders.

Course Objectives:

Upon completion of this course, participants will be able to:

- Analyze core concepts and strategic responsibilities of advanced social protection financing strategies for achieving universal coverage and adequacy.

- Master sophisticated techniques for conducting comprehensive fiscal space analysis to identify potential resources for social protection expansion.

- Develop robust methodologies for designing and implementing innovative domestic resource mobilization (DRM) strategies to fund social protection programs.

- Implement effective strategies for identifying and re-allocating public expenditures to create fiscal space for social protection investments.

- Manage complex considerations for understanding and navigating the political economy of social protection financing reforms and building consensus.

- Apply robust strategies for developing shock-responsive financing mechanisms to ensure social protection can scale up during crises.

- Understand the deep integration of international cooperation and development finance in complementing domestic efforts for social protection financing.

- Leverage knowledge of global best practices and lessons learned from successful social protection financing reforms in diverse country contexts, particularly in Africa (including Kenya).

- Optimize strategies for utilizing new and emerging financial instruments (e.g., social bonds, impact investments) for social protection.

- Formulate specialized recommendations for conducting actuarial valuations and ensuring the long-term financial sustainability of contributory social security schemes.

- Conduct comprehensive assessments of financial and operational efficiency in social protection programs to optimize resource utilization.

- Navigate challenging situations such as high public debt, economic volatility, informal economies, and political resistance in securing social protection financing.

- Develop a holistic, evidence-based, and politically astute approach to designing and implementing Advanced Social Protection Financing Strategies, ensuring the sustainable funding of inclusive social protection systems.

Target Audience:

This course is designed for professionals interested in Advanced Social Protection Financing Strategies:

- Senior Officials from Ministries of Finance, Planning, and Social Affairs: Responsible for national budget formulation and resource allocation, with a specific focus on social sector financing in Kenya.

- Economists and Fiscal Policy Analysts: Working in government, central banks, and research institutions, particularly those analyzing public finance in African contexts.

- Social Protection Program Managers: Overseeing large-scale social assistance or social security schemes, including Kenya's National Safety Net Programme (NSNP).

- Actuaries and Social Security Specialists: Involved in financial sustainability assessments of social insurance, such as Kenya's NHIF and NSSF.

- Development Partners & International Financial Institutions (IFIs): Supporting social protection financing reforms and technical assistance in developing countries.

- Public Financial Management (PFM) Experts: Focused on improving efficiency and transparency in public spending within government agencies.

- Researchers & Academics: Specializing in public finance, social policy, and development economics, with an interest in sustainable development.

- Civil Society Organization (CSO) Leaders: Advocating for increased and more equitable social protection financing and fiscal transparency.

Course Duration: 10 Days

Course Modules:

- Module 1: Foundations of Social Protection Financing

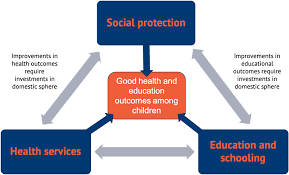

- The Case for Investing in Social Protection: Economic, social, and human rights arguments.

- Overview of Social Protection Typologies: Contributory vs. non-contributory schemes, their financing implications.

- Basic Financing Mechanisms: General taxation, social security contributions, targeted taxes, external aid.

- Global Trends in Social Protection Expenditure: Benchmarking and regional comparisons (e.g., Africa vs. other regions).

- Challenges in Social Protection Financing: Fiscal constraints, informality, political will, economic shocks (with examples from Kenya, including debt service pressures).

- Module 2: Fiscal Space Analysis for Social Protection

- Defining Fiscal Space: Understanding the capacity of a government to provide resources for public purposes.

- Methodologies for Fiscal Space Assessment: Macroeconomic context, debt sustainability analysis.

- Four Pillars of Fiscal Space: Reallocating public expenditure, improving tax revenue, borrowing, external aid.

- Quantifying Fiscal Space for Social Protection Expansion: Tools and models for projections.

- Practical Application: Case study on assessing fiscal space for a new social protection program in Kenya.

- Module 3: Advanced Domestic Resource Mobilization (DRM) - Tax Reforms

- Taxation for Social Protection: Progressive income tax, corporate tax, wealth tax.

- Indirect taxation: VAT, excise taxes, carbon taxes, digital services taxes (with Kenyan examples).

- Broadening the Tax Base and Improving Compliance: Strategies to enhance revenue collection and address illicit financial flows.

- Revenue potential and distributional impact of various tax policy reforms.

- Case studies of successful tax reforms for social protection financing.

- Module 4: Advanced Domestic Resource Mobilization (DRM) - Non-Tax & Other Sources

- Expanding Social Security Contributions: Strategies for extending coverage to the informal economy (relevant for Kenya's NHIF/NSSF).

- Revenues from Natural Resources: Exploring the potential of mineral wealth and other natural assets.

- Leveraging Public Assets and State-Owned Enterprises: Optimizing returns and re-investing profits.

- Dedicated Levies and Earmarked Taxes: Exploring specific funding sources for social protection.

- Addressing Illicit Financial Flows: Impact on domestic revenue and social protection financing.

- Module 5: Strategic Expenditure Re-allocation and Efficiency Gains

- Identifying Inefficient or Regressive Spending: Fuel subsidies, inefficient public enterprises, military spending (potential re-allocation).

- Expenditure Reviews and Value for Money Assessments: Tools for optimizing public spending.

- Rationalizing Public Sector Wages and Benefits: Creating fiscal space through reforms.

- Improving Efficiency of Social Protection Programs: Administrative cost reduction, better targeting, digital payments (as used in Kenya's cash transfers).

- Public-Private Partnerships (PPPs) in Social Protection: Opportunities and risks for financing.

- Module 6: The Political Economy of Social Protection Financing Reforms

- Stakeholder Analysis: Identifying key actors and their interests in financing reforms (e.g., political parties, trade unions, civil society).

- Building Political Will and Consensus: Strategies for advocacy, dialogue, and coalition building.

- Overcoming Resistance to Reforms: Addressing opposition from vested interests and managing public perception.

- Communication Strategies: Explaining the benefits and costs of social protection investments to the public and policymakers.

- Navigating Macroeconomic Constraints and Austerity: Balancing fiscal consolidation with social protection needs.

- Module 7: Shock-Responsive Financing for Adaptive Social Protection

- Contingency Financing Mechanisms: Dedicated funds, budget re-allocations, insurance schemes (e.g., drought insurance in ASALs).

- Climate Risk Financing and Social Protection: Linking climate finance to adaptive social protection.

- Parametric Insurance and Catastrophe Bonds: Innovative instruments for disaster response.

- Forecasting and Trigger Mechanisms: Using early warning systems to trigger financing and scale-up.

- Rapid Disbursement Mechanisms: Leveraging digital payments for crisis response, as seen during COVID-19.

- Module 8: Role of International Cooperation and Development Finance

- Official Development Assistance (ODA) for Social Protection: Trends, challenges, and effectiveness, particularly in Kenya.

- Multilateral Development Banks (MDBs) and International Financial Institutions (IFIs): Lending, grants, and technical assistance.

- Debt Relief and Restructuring: Creating fiscal space in highly indebted countries (relevant for Kenya's current debt situation).

- South-South Cooperation: Learning and financing from emerging economies.

- Aligning External Financing with National Priorities: Ensuring country ownership and sustainability.

- Module 9: New and Emerging Financial Instruments for Social Protection

- Social Bonds and Impact Investing: Attracting private capital for social outcomes.

- Philanthropic Contributions and Foundations: Role in supplementing public finance.

- Crowdfunding and Digital Fundraising: Harnessing new technologies for resource mobilization.

- Leveraging Diaspora Remittances: Opportunities for social investment and linking to social protection.

- Exploring Universal Basic Income (UBI) financing models and their feasibility.

- Module 10: Actuarial Analysis and Long-Term Sustainability of Contributory Schemes

- Principles of Actuarial Valuation: Assessing the financial health of social security schemes (e.g., NSSF, NHIF).

- Demographic and Economic Projections: Impact on long-term liabilities and revenues.

- Addressing Funding Gaps and Deficits: Policy options for ensuring solvency (e.g., contribution rates, retirement age, benefit levels).

- Governance and Investment of Social Security Funds: Ensuring prudent management and returns.

- Transitioning from Pay-As-You-Go to Partially Funded Systems: Strategies and challenges.

- Module 11: Fiscal Risk Management and Resilience Financing

- Identifying and Assessing Fiscal Risks: Macroeconomic shocks, demographic shifts, natural disasters, epidemics.

- Developing Contingency Plans and Fiscal Buffers: Mechanisms for preparing for unforeseen events.

- Role of Budget Stabilization Funds and Sovereign Wealth Funds.

- Integration of Fiscal Risk Management into Overall Public Financial Management Frameworks.

- Building Resilience into Social Protection Financing: Ensuring systems can adapt and respond to shocks.

- Module 12: Developing a National Social Protection Financing Strategy

- Elements of a Comprehensive Financing Strategy: Goals, objectives, proposed mechanisms, timeline.

- Costing and Affordability Analysis: Developing detailed financial projections for proposed reforms.

- Risk Assessment and Mitigation in Financing: Identifying financial risks and proposing countermeasures.

- Monitoring and Evaluation of Financing Strategies: Tracking progress and making adjustments.

- Case Study and Group Exercise: Participants develop a strategic financing roadmap for expanding social protection in a specific country context, incorporating lessons from Kenya's financing